All Categories

Featured

[/image][=video]

[/video]

Withdrawals from the cash money worth of an IUL are commonly tax-free approximately the amount of costs paid. Any withdrawals over this amount might go through tax obligations depending on plan structure. Conventional 401(k) contributions are made with pre-tax dollars, lowering gross income in the year of the contribution. Roth 401(k) contributions (a strategy feature offered in many 401(k) strategies) are made with after-tax contributions and then can be accessed (profits and all) tax-free in retired life.

Withdrawals from a Roth 401(k) are tax-free if the account has actually been open for a minimum of 5 years and the individual is over 59. Assets taken out from a standard or Roth 401(k) prior to age 59 might sustain a 10% charge. Not exactly The claims that IULs can be your very own bank are an oversimplification and can be misleading for several reasons.

:max_bytes(150000):strip_icc()/Pros-and-cons-indexed-universal-life-insurance_final-1b83c0fd52154eb69edd47f99ab8927a.png)

You might be subject to upgrading linked wellness questions that can impact your continuous expenses. With a 401(k), the money is always your own, consisting of vested employer matching no matter of whether you stop adding. Risk and Warranties: First and foremost, IUL policies, and the cash money worth, are not FDIC insured like common savings account.

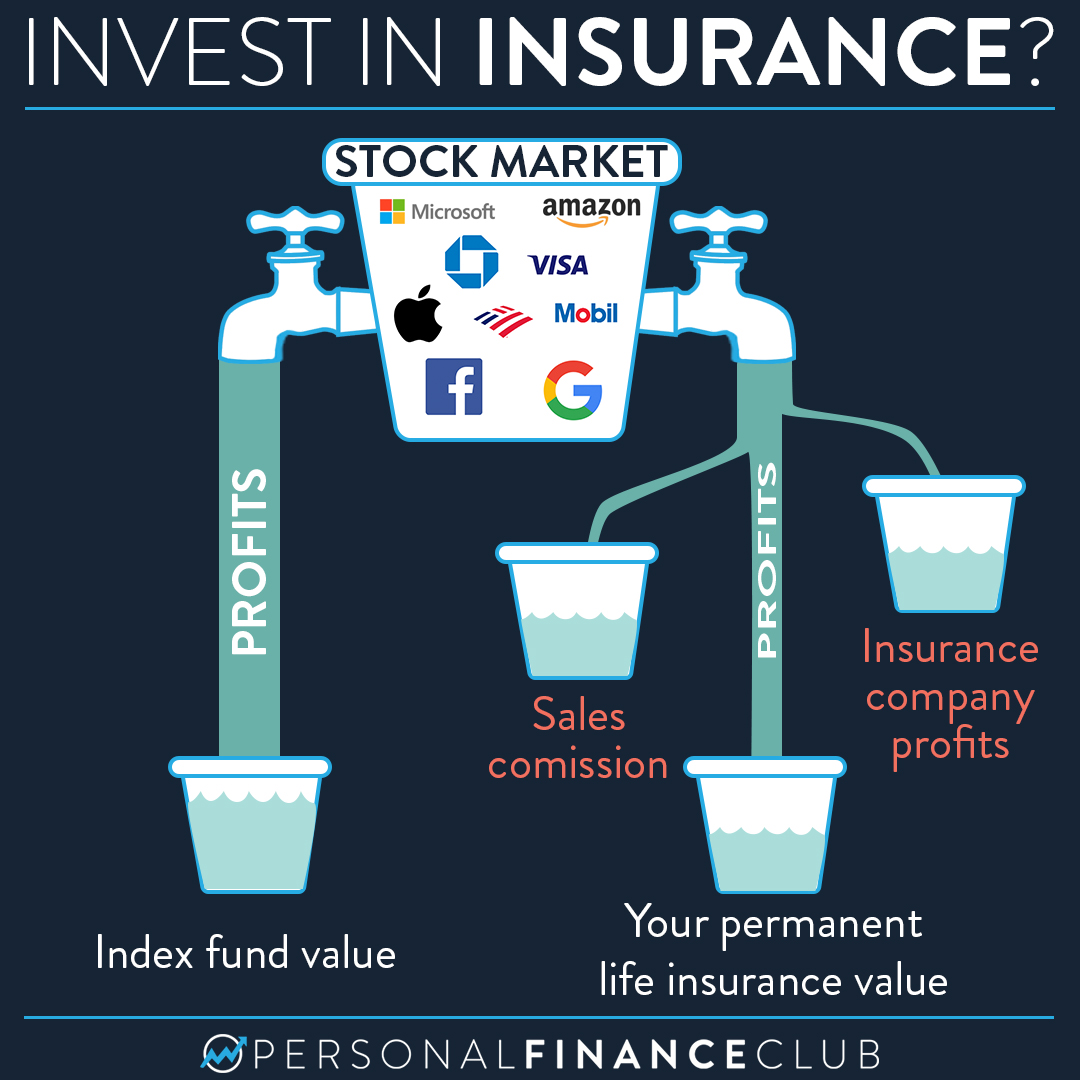

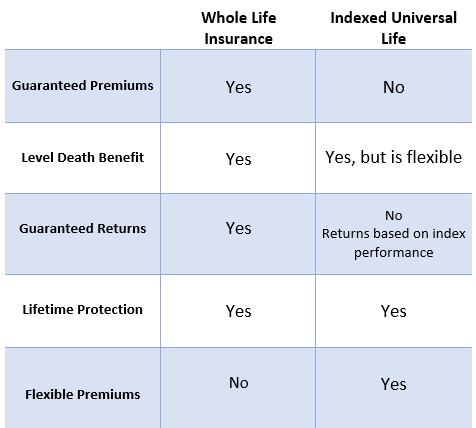

While there is normally a flooring to avoid losses, the development potential is covered (suggesting you may not fully gain from market growths). Many professionals will certainly agree that these are not equivalent items. If you want death benefits for your survivor and are worried your retired life financial savings will certainly not be enough, after that you may intend to consider an IUL or various other life insurance policy item.

Sure, the IUL can supply access to a money account, yet once more this is not the primary objective of the product. Whether you desire or need an IUL is a very individual inquiry and depends upon your key financial purpose and objectives. Nonetheless, below we will attempt to cover advantages and restrictions for an IUL and a 401(k), so you can further mark these products and make a much more informed decision pertaining to the best method to handle retired life and dealing with your enjoyed ones after fatality.

Iul Insurance Leads

Finance Prices: Fundings against the plan accumulate rate of interest and, if not paid back, lower the survivor benefit that is paid to the recipient. Market Involvement Limits: For a lot of policies, financial investment growth is connected to a stock exchange index, however gains are generally topped, restricting upside possible - wrl iul. Sales Practices: These plans are frequently marketed by insurance policy agents who might stress benefits without totally describing prices and threats

:max_bytes(150000):strip_icc()/indexed-universal-life-insurance.asp-Final-9f72d52f11d643c693ab8b3600f3cd27.png)

While some social media experts recommend an IUL is an alternative item for a 401(k), it is not. Indexed Universal Life (IUL) is a type of long-term life insurance plan that additionally offers a cash value part.

Latest Posts

Indexed Universal Life Insurance

Is Indexed Universal Life A Good Investment

Iul Explained